A new Goldman Sachs report found more than a quarter of women (28%) are saving less than $50,000 for retirement.

“Assuming a 4% withdrawal rate, $50,000 in retirement savings provides $2,000 of income per year,” noted the report’s authors. “At these levels, Social Security benefits are an essential part of retirement income strategy. However, according to the Social Security Administration, women on average receive 22% less in Social Security benefits driven in part by pay gaps and part-time work.”

In a supplement to its 2023 Retirement Survey & Insights Report called Challenges Women Face Saving for Retirement, Goldman Sachs Asset Management looked at data from 5,261 survey respondents across gender, age and job status. Approximately 30% had retired at the time of the survey in July.

In addition to losing out on more Social Security income due to factors often associated with caregiving, women also tend to retire earlier than planned and for more unexpected reasons. Combined with persisting income disparities, women are retiring with anywhere from 24% (according to Goldman) to 30% (according to Tina Sanchez, head of national retirement accounts for BlackRock) less savings than the other 49.49% of the U.S. population.

“The recent market environment has been hard on everyone, but it is important that we acknowledge that women, and especially women of color, have been hit the hardest,” Sanchez said during a recent webinar, hosted by Vestwell, discussing women and retirement.

“We refer to it as the triple whammy,” she said. “It’s the pay gap: on average, women still make less than men; it’s about 83 cents on the dollar now. It’s the gaps in employment: women are disproportionately often the caregivers spending time out of the workforce to care for loved ones. And it’s longevity: we know women live, on average, five years longer than men.”

Despite these challenges, the Goldman report found improvements in the retirement outlook of working women, including reduced stress in managing savings, increased confidence and more savings over the previous year.

The study also delved into how gender-based differences may affect investment priorities, preferences and market reactions.

Working women are still more likely to feel they’re not saving enough for retirement; 43% feel like they’re behind schedule, while a little more than a fifth think they’re ahead. By comparison, 37% of working men feel like they’re ahead and three in ten want to catch up.

However, women reported feeling more comfortable with their savings than they were a year earlier. Just half said managing retirement savings is stressful, down from 63% the previous year and compared with 42% of their male counterparts.

“Of course, while it is important to see the positive development, it is still significant that half of surveyed women report feeling stress managing their savings,” noted the report’s authors.

Women also reported that the struggle to balance multiple financial goals, dubbed the “financial vortex” by GSAM, was having less impact on their retirement plan in 2023 than in the previous year. Including things like credit card debt, saving for college, supporting family members, high monthly expenses and unexpected costs, women were feeling better across the board—a trend that was reversed among the men.

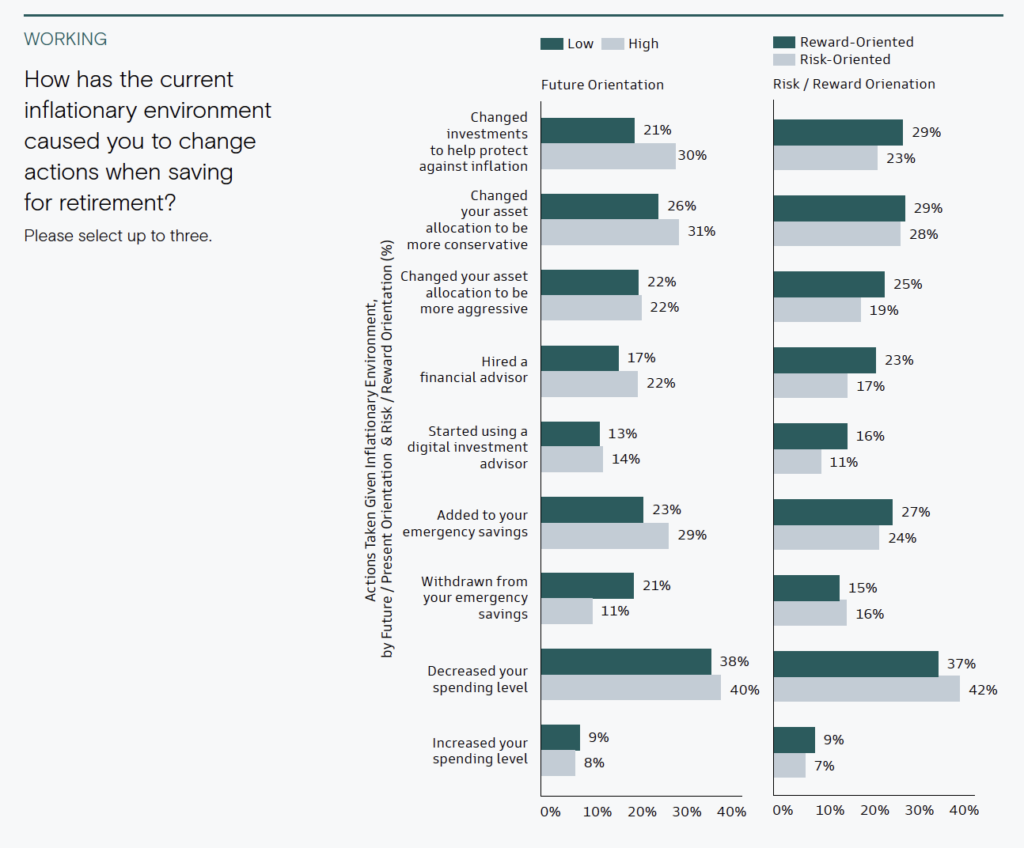

According to the analysis, this indicates women may be more oriented to the present and risk-averse while men are more rewards-driven and focused on the future, characteristics that can have a significant impact on investment choices in different market environments.

“This highlights the deeply personal nature of financial goals, and the usefulness of periodically accessing calculators and tools to evaluate retirement readiness and enhance confidence,” according to GSAM Senior Retirement Strategist Chris Ceder. “Planning assumptions should be evaluated along with each individual’s vision for retirement.”

During the conversation with Vestwell, BlackRock’s Sanchez and Bonnie Treichel, founder of Endeavor Retirement, highlighted the need for broader access to education and financial resources to help women retire with more security. Sanchez recommended a combination of active investment management strategies and target date funds.

“If women feel like they’re under-saving, they should definitely be considering active management strategies to help make up for the savings shortfall by providing more alpha,” Sanchez said. “And with target date funds, women’s investing behavior is super encouraging. We see women invest for the long term.”

Treichel and Tali Vaughn, regional VP of sales and consulting for retirement plan administrator EGPS, both suggested customized planning may help address some of the unique challenges women face due to living longer and bearing the brunt of family caregiving. They noted that proactive advice around the Secure 2.0 provisions pertaining to part-time, freelance and gig economy workers, emergency savings programs and student loan debt could be especially useful to women.

Ultimately, the GSAM research found roughly three-quarters of retired women and two-thirds of retired men are living on less than 70% of their working income. About a third of women are dissatisfied with this, compared to a fifth of men.

“We do need to talk about our finances more and to vocalize our priorities,” said Vestwell’s Kim Andranovich, citing a recent Forbes article by Jamie Hopkins. “The balance of wealth is shifting and as a result of living longer, women will be the primary wealth holders probably within the next decade.

“So, it’s absolutely important.”

For a complimentary review of your retirement profile, contact our office at 775-789-3140 or through our website https://www.gbfinancial.org/contact.

Source: WealthManagement.com